According to IDC, Vivo is at the third spot with 3.9 million units in October, compared to 2.9 million from 2019. Realme is in fourth place as it could ship 3.0 million units, which registered a 48.2 percent growth in October and is also the highest among all the brands. OPPO came in fifth position with 2.7 million units, a YoY growth of 40.2 percent. Other brands accounted for 2.4 million units. IDC says the growth in India was due to the increase in online sales and high demand in the third quarter of this year. Notably, the units shipped in India happens to the highest-ever for October month and second-highest for a single month after 23 million units in September this year.

IDC says the growth in India was due to the increase in online sales and high demand in the third quarter of the year.

Table of Contents

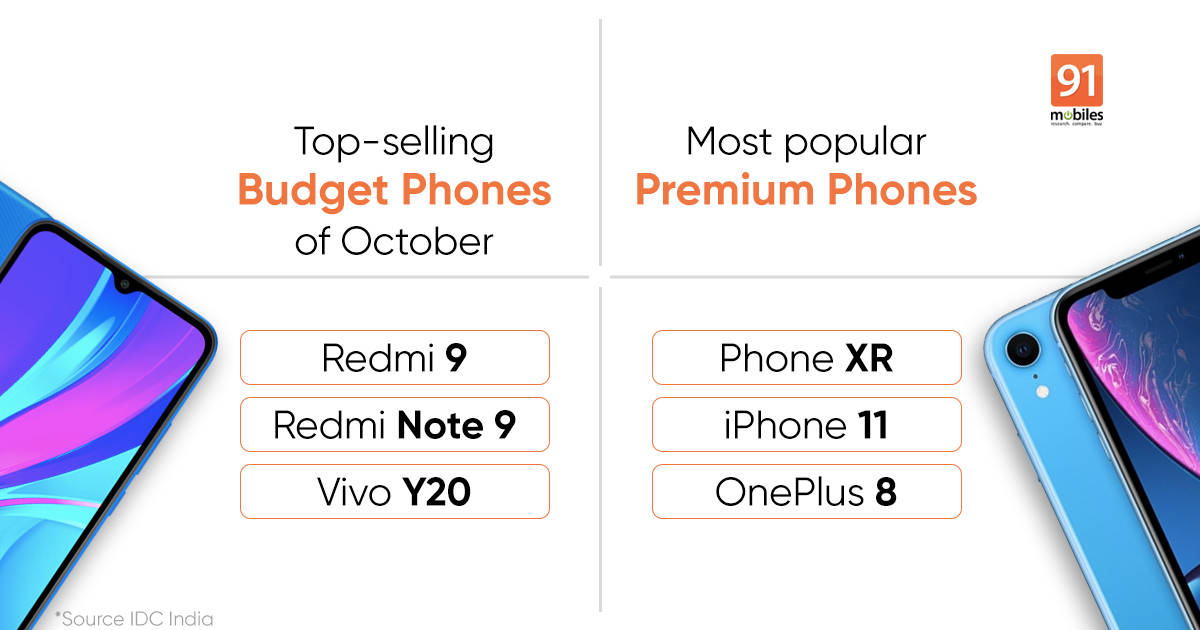

Best selling models in October in India

The report further says phone purchases between Rs 8000 to Rs 16,000 grew by 60 percent YoY. Redmi 9, Redmi Note 9, and Vivo Y20 were the top-selling models in the segment. Apple led the premium segment (Rs 35,000 to Rs 50,000) in India, with a growth of 16 percent YoY in October. iPhone XR, iPhone 11, and OnePlus 8 were the most popular models in this segment, with sales driven by affordability schemes and offers.

As many as 68 percent of the smartphones sold in October were under $200 (about Rs 15,000). Xiaomi was the leader in the budget segment, while Samsung led the $200-300 (roughly Rs 15,000-22,000) bracket; this price bracket accounted for about 25 percent of all smartphone sales during the period. The premium ($500+/ Rs 35,000+) segment had a 5 percent share of the overall sales in October, with Apple being the top brand in 49 of the top 50 cities.

5G smartphones was sales of 5,00,000 units in October, with 80 percent of the units purchased in the top 10 cities. IDC India Market Analyst Sachin Mehta in the report said “uncertainties on spectrum availability, clear use cases, and high prices” might limit the sales of 5G smartphones in a few big cities.

Cities driving the growth

Cities such as New Delhi, Mumbai, Bengaluru, Chennai, and Kolkata accounted for as much as 25 percent of the sales, with e-learning driving demand in the bigger cities. Sales in Jaipur, Gurgaon, Chandigarh, Lucknow, Bhopal, and Coimbatore grew by 50 percent. However, other regions only saw an average of 25 percent increase in demand due to economic concerns and consumer spending focussing only on essentials. The top 50 cities were responsible for 55 percent of the national demand.

Online vs offline

Online platforms were the major source of smartphones sale as they accounted for 50 percent of the total sales. This is a 23 percent YoY growth. Supply chain restrictions offline sales as a result of fewer walk-ins during the October month.

Xiaomi was the top online brand in 34 of the top 50 cities in October 2020, while Vivo was the most popular offline brand in 44 of the top 50 cities.

![[Update] Vivo V30e India launch date announced; key specifications and features revealed Thumbnail](https://www.91-cdn.com/hub/wp-content/uploads/2024/04/Vivo-V30e.jpg?tr=h-110,q-100,pr-true)