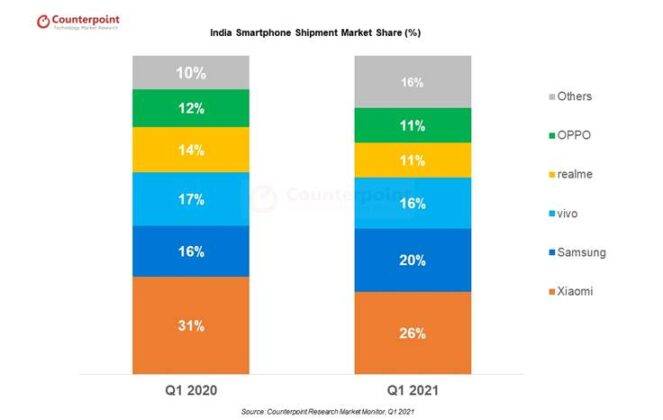

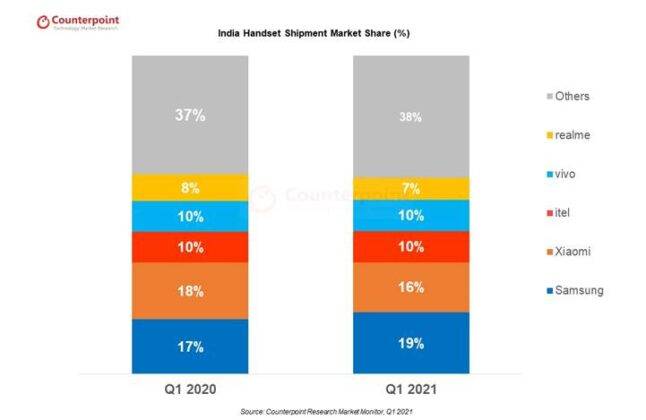

Samsung seems to have made quite an impressive recovery after its somewhat lackluster Q1 2020. Its Galaxy M, Galaxy F, and Galaxy A series launches have worked their magic, with the Galaxy A32, Galaxy A52, Galaxy A72, and Galaxy M12 starting the show. The Galaxy S21 series, on the other, hand failed to make much of an impression, but that is somewhat understandable. Vivo’s X series of smartphones seem to have made quite a splash, too, especially the Vivo X60. We can’t say the same for its cousin Realme, though. Despite its non-stop product launches, the newcomer lost 4% market share in Q1, 2021. Realme could remedy this in Q2 with its low-cost 5G-ready smartphones.

OPPO had a fairly decent year, too, with a growth rate of 12% year-over-year and a market share of 11%. OPPO has lost a lot of ground over the years, especially to the likes of Xiaomi and Realme. Meanwhile, POCO saw a whopping 553% growth compared to last year, mostly due to the POCO M2 and X3 Pro. Apple and OnePlus grew by 207% and 300%, respectively in the high-end segment, which is hardly surprising, considering that neither company competes in other segments. The often-ignored Transsion (Itel, Infinix, Tecno) group moved an impressive number of smartphones, too.

![[Exclusive] iQOO is evaluating launch of gaming tablet in India Thumbnail](https://www.91-cdn.com/hub/wp-content/uploads/2024/04/Vivo-Pad-3-Pro-as-iQOO-Pad-2.png?tr=h-110,q-100,pr-true)