With digital payments on the rise in India, the Reserve Bank of India’s governor, Shaktikanta Das, recently announced a new feature called UPI Lite X. This feature allows people to send and receive money even in places where there’s no internet connection, making offline transactions possible. Let’s explore the specifics of UPI Lite X and how to use it.

Table of Contents

UPI Lite X: what is it, and how is it different from UPI Lite?

- UPI Lite X is an enhanced version of UPI Lite. The fundamental idea remains unchanged as in this method, the payment app establishes an on-device wallet.

- Users are required to manually transfer funds from their savings account to this wallet.

- Following this step, users can utilise these funds for transactions, both between individuals and with merchants (P2M and P2P).

- The significant convenience here is that for transactions up to Rs 500, there’s no need to enter the UPI PIN.

- However, one major difference between the two is that UPI Lite requires an internet connection to carry out transactions.

- But, NPCI has introduced offline payment capabilities with UPI Lite X, enabling transactions to be done without the need for an internet connection.

- Furthermore, UPI Lite X has incorporated support for Tap and Pay, allowing users to employ NFC technology for UPI transactions.

- It is worth noting that the transaction limits for UPI Lite X are the same as UPI Lite.

UPI Lite X: how to set it up on the Bhim app?

To use UPI Lite X, users will need an Android smartphone with NFC support. iPhones are not compatible with UPI Lite X because Apple doesn’t allow third-party apps for NFC payments on their devices. To ensure that UPI Lite X is compatible with your Android phone, you need to meet the following requirements:

- Both the sender and receiver should have the latest version of the BHIM App installed.

- Both the sender and receiver should have Android devices that support NFC.

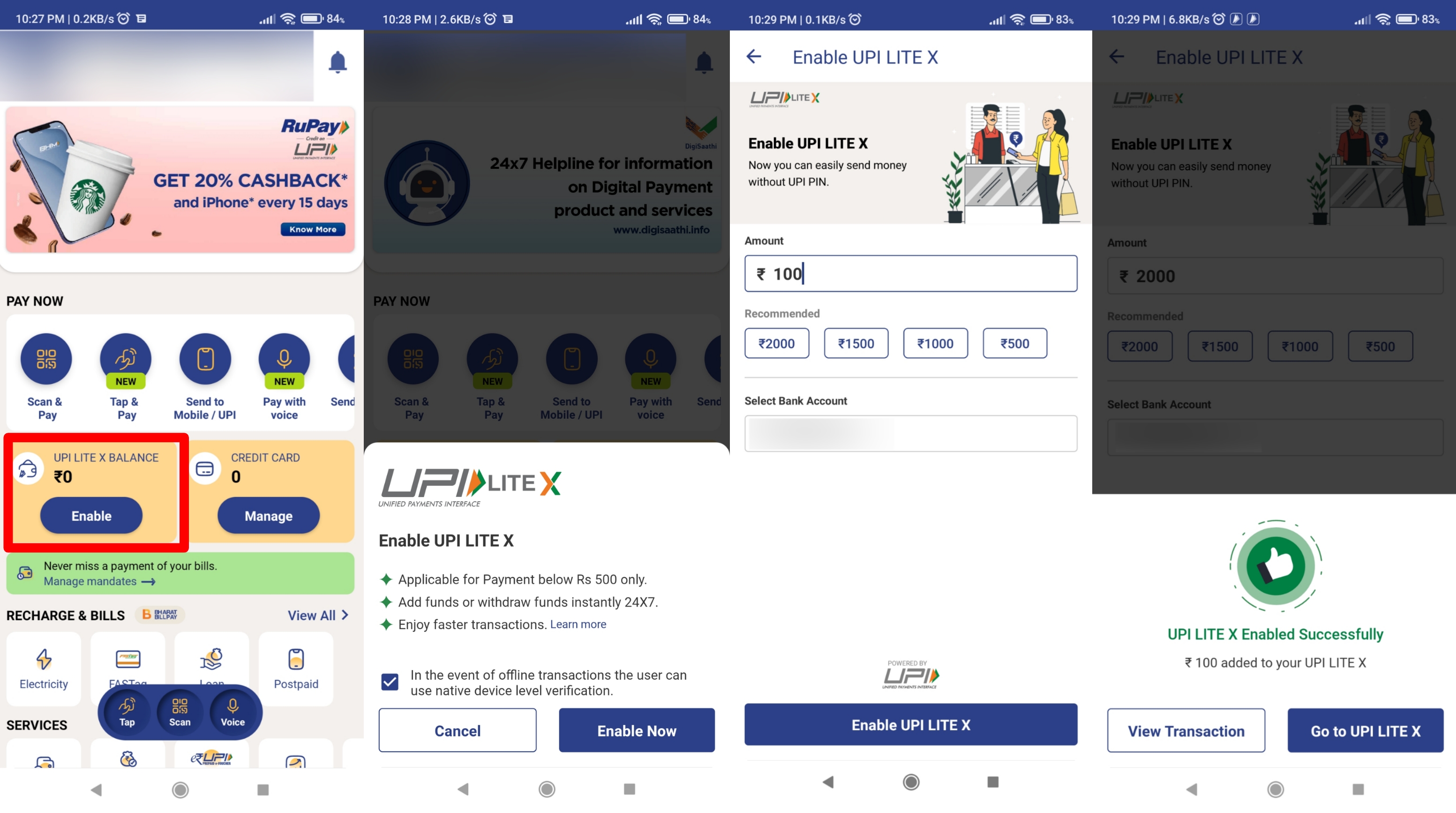

Here’s a step-by-step guide to enabling and using UPI Lite X on your Android phone:

- Open the BHIM App and go to the ‘UPI Lite X Balance’ menu.

- Tap on the ‘Enable’ button.

- Toggle the tickbox to give permission for offline transactions and then tap ‘Enable Now.’

- The app will prompt you to add funds to your UPI Lite wallet. Enter the desired amount.

- Click the ‘Enable UPI Lite X’ button.

- You’ll be prompted to input your UPI PIN.

- Once the funds are added to your wallet, you can start using UPI Lite X for Tap and Pay as well as offline transactions.

UPI Lite X: How to use it for Tap and Pay, offline transactions

- Enable NFC on both the sender’s and receiver’s Android phones.

- Open the BHIM App on the sender’s phone and tap ‘Tap & Pay.’

- Enter the payment amount and optionally add a custom remark.

- Confirm the transaction.

- The BHIM App on the sender’s device will enter transaction mode; ensure the screen remains on.

- Unlock the screen on the receiver’s phone.

- Bring both devices close and touch gently.

- The sender’s phone will display ‘Device Connected.’

- Hold both devices in the same position.

- Your UPI Lite X transaction is now completed.

UPI Lite X: things to note

- For UPI Lite X transactions done offline, the receiver must connect to the internet within 4 days to receive the funds correctly.

- Only 11 banks in India currently support UPI Lite X: Canara Bank, HDFC Bank, State Bank of India (SBI), Axis Bank, Central Bank of India, Kotak Mahindra Bank, Punjab National Bank, Union Bank, Indian Bank, Utkarsh Small Finance Bank, and Paytm Payments Bank.

- UPI Lite X allows individual transactions up to Rs 500, with a daily limit of Rs 4,000. Users can hold a maximum of Rs 2,000 in their UPI Lite X wallet.

- As of now, the BHIM App offers Tap and Pay and offline transactions for UPI Lite X. Third-party apps like PhonePe and Paytm are expected to introduce this feature in the coming weeks.