Tech giant Apple has taken action to remove a number of harmful lending apps from its App Store in the country. These apps were known for engaging in predatory practices.

Apple bans six loan apps from App Store

- The apps include Pocket Kash, White Kash, Golden Kash, and OK Rupee.

- According to numerous user reviews, it was reported that these apps imposed excessively unnecessary charges.

- The lenders utilised unethical tactics to coerce borrowers into repaying their loans.

- In recent weeks, the apps providing fast-track lending services to consumers in India have gained significant popularity, reaching the top 20 of the finance list on the App Store.

Here’s why Apple banned these apps

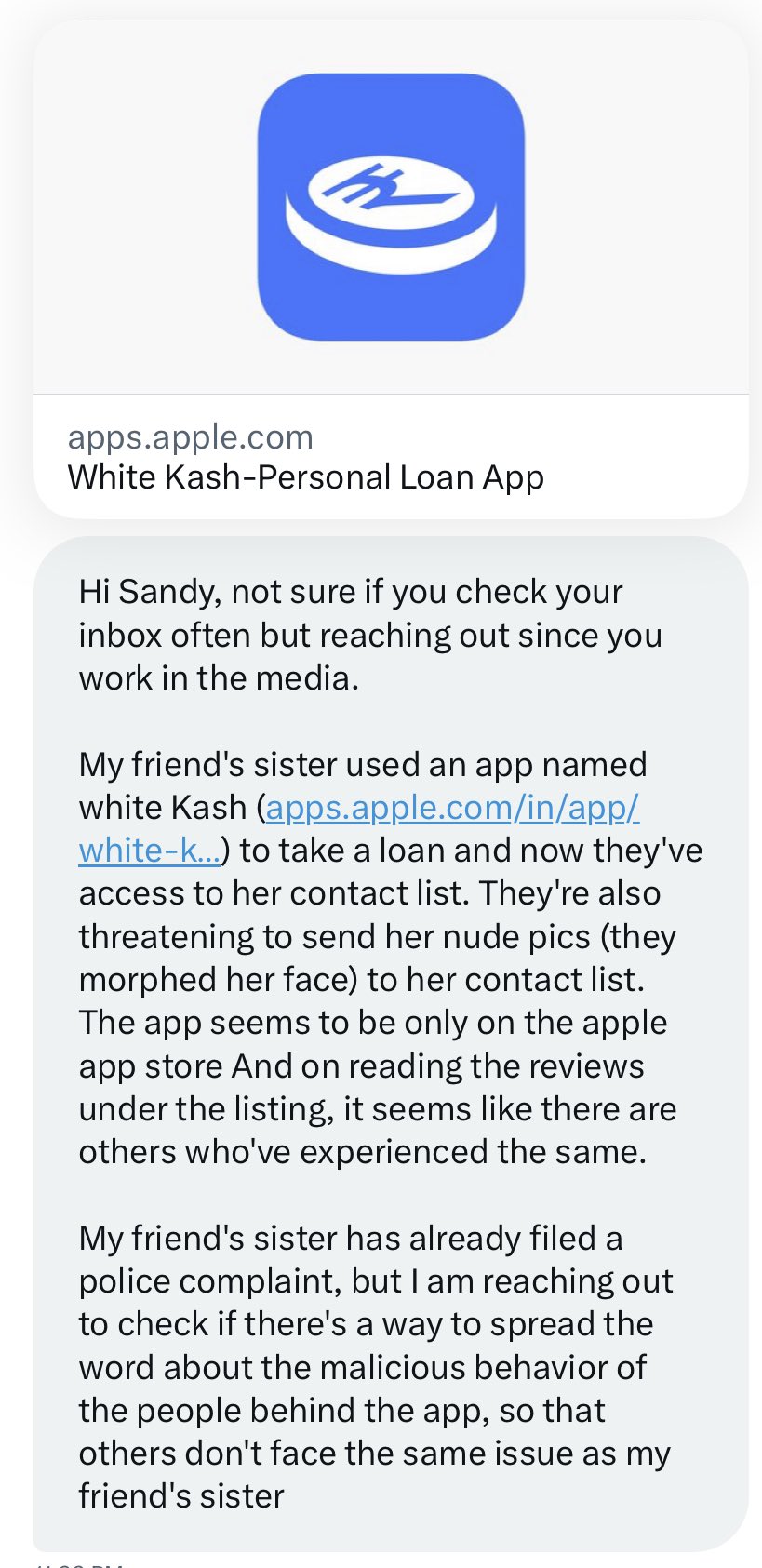

Several users have reported receiving messages that contain personal photos and contact information. These messages include threats to expose their loan status to their contacts if they do not repay on time.

The applications, created by individuals with questionable identities and websites, received an overwhelming number of identical reviews. Some of these reviews even detailed more concerning threats from the lenders.

Therefore, as a response to these concerns, the loan apps were removed from the App Store due to their violation of the rules and guidelines outlined in the Apple Developer Program License Agreement. Several apps were discovered to be falsely asserting their affiliation with financial institutions.

It should be noted that the lending apps that engage in such practices not only invade user privacy but also expose individuals to harassment and possible blackmail. These actions show that there is a pressing need for stronger regulations and oversight in the digital lending industry to safeguard users from exploitative practices.

![[Exclusive] iPhone 16 Pro CAD renders show off new button, bigger size, and more Thumbnail](https://www.91-cdn.com/hub/wp-content/uploads/2024/03/iphone-16-pro-cad-renders-feat.jpg?tr=h-110,q-100,pr-true)